Optimal Mix

401k plans are "defined contribution" plans which means that you or a trustee will choose where to invest the money. Unlike a "defined benefit" plan, the amount you'll be able to withdraw from your 401k account when you retire will not be set, but will depend on how much the assets in the plan have grown (or shrank!). Thus it's important that you choose assets that are right for you.

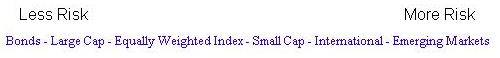

Different mixes of a 401k will be right for you depending on your age, status, and preferences. Remember that with all assets there is a risk-return tradeoff. While younger 401k holders should consider a more aggressive and risky portfolio, older 401k holders should be more conservative. An aggressive portfolio may give higher returns in the long run, but is subject to much more volatility in the short run. Below is a basic illustration of the types of returns that different mutual funds can give.

Many companies now provide mutual funds that do the risk-return work for you. These funds are managed specifically for people that are planning on retiring in a given year. As the date approaches the target retirement year, the fund managers will move your savings from more volatile assets to more steady assets.

The Fidelity Freedom Funds are an example of these types of mutual funds. While the Fidelity Freedom 2010 Fund is likely to be steady and give a relatively low return, the Fidelity Freedom 2040 Fund is likely to be more volatile but also provide higher long term returns.

|