Merger Arbitrage

When a merger is announced the stock market immediately reacts. Although the stock price of the target may come close to the offer price, there will always be a spread between the offer and the target price. This spread represents the risk that the merger will not go through. Merger arbitrage is a technique used to profit from this spread; it is a fairly simple concept.

Assuming that two public companies are merging, typically, two stock moves happen when a merger is announced:

- (1) The stock of the acquirer decreases slightly, and

- (2) the stock of the target jumps significantly.

The jump in the target stock is based on the offer price. The offer can come in many forms, but merger offers are generally found between two extremes: an all cash offer or a pure stock offer. Merger transactions can also be a combination of these two, and they can also include debt, such as bonds, instead of cash. A deal can also be tiered such that a base price is guaranteed and a "bonus" is given on completion of certain performance criteria (such was the case in this Huntsman deal that fell through).

Merger arbitrage is possible since a target firm's stock will probably not reach the offer price until the deal is finalized and the stock is de-listed. This is due to the risk of the merger not going through, and this risk makes "merger arbitrage" a somewhat risky form of arbitrage. Many merger deals have been announced, only to run into opposition from the board, shareholders, and/or the Department of Justice (or other governmental organizations).

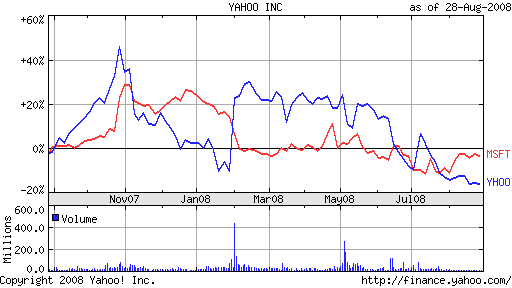

Microsoft's recent offer for Yahoo! is a good example of a merger that didn't happen (at least not as of the day this article was written). Microsoft made a 1/2 cash 1/2 stock bid on February 1, 2008 to purchase Yahoo for $31 per share. Yahoo shares jumped up from about $21 to $29 that day. Notice that Microsoft stock decreased at the same time. Over the next couple months, Microsoft made other offers to try to pressure Yahoo's board, lead by Yang, to sell. Ultimately Yang prevailed in blocking the bid, and now Yahoo stock is back to where it began.

How to Conduct Merger Arbitrage

To conduct merger arbitrage, one must purchase the stock after the announcement and hope to sell the stock after the stock approaches the offer price. An all-cash offer is the easiest on which you can perform merger arbitrage: simply purchase stock and wait for it to approach the offer price. Either sell the stock when you're satisfied, or wait to receive the offer (cash, bond, or stock).

For example (this was not the actual offer), if Microsoft had bid $31 in all cash for Yahoo, then one could simply buy Yahoo stock after hearing about the merger. If you're able to get in at $28 and the deal ultimately goes through, then you will receive $31 per share and you will have made 10.7% (31/28 - 1). If the deal goes through within 6 months, then you will have made an annualized return of 21.4%. Not bad.

Merger arbitrage becomes a bit more complicated when the deal is all stock. In an all stock deal, you must purchase the target stock (long), and short sell the acquirer stock. This protects against changes in the acquirer stock, which will effectively change the offer price. For every stock you purchase of the target firm, you must purchase the amount of acquiring stock that you will receive when the deal goes through.

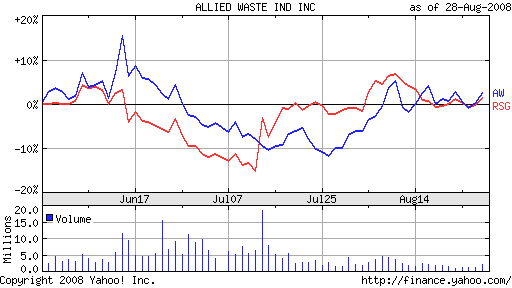

For example, Republic Services (RSG) is currently merging with Allied Waste (AW). The standing offer is 0.45 shares of RSG stock for each share of AW stock. On 8/28/08, AW closed at 13.32 and RSG closed at 33.24. By multiplying .45 by RSG stock value, we can obtain the AW target price: .45 * 33.24 = 14.96. Since AW is valued at 13.32, there is potential for a 12.3% gain (14.96/13.32 - 1) (36% annualized). We've only completed one part of our transaction. The other part is to lock in our price -- we have to protect against changes in the acquirer's stock. We can do this by shorting RSG. Here are a few scenarios that may occur, which demonstrate why we must short:

- RSG decreases to 28.00: we gain 2.36 on RSG ((33.24 - 28.00) * -0.45) and we lose 0.72 on AW ((28.00 * .45) - 13.32). Luckily, since we shorted RSG, we will still make 1.64 per AW share (2.36 + -0.72), a 12.3% return (1.64/13.32).

- RSG increases to 36.00: we lose 1.24 on RSG ((22.24 - 36.00) * -0.45) and we gain 2.88 on AW ((36.00 * .45) - 13.32). This represents (you guessed it) a 12.3% return.

You may think that we would have been better off going long on RSG in the second scenario, and you'd be right. But we're not trying to bet on stock prices, we are trying to bet on whether a merger will go through.

If you look at AW and RSG stock prices for July and August of 2008, you'll see some big ups and downs. These were mostly due to Waste Management (WMI), who added risk to the deal by making an offer for Republic Services during the merger process (before it closed). The first offer was for $33 per RSG share and the second was for $37 per RSG share. RSG's board was obligated to consider every offer WMI made, and there is still risk that WMI will try again even though RSG rejected the first two offers. Thus, the large 12.3% return that one could get by arbitraging AW reflects the amount of risk in the deal.

You can see how the market judges the risk of the deal by viewing the chart above. It's easy to spot when Republic Services made the offer for Allied Waste. Note how the stocks follow each other closely for several days. Note also that when Waste Management made the offer for Republic Services. At that point, AW stopped tracking RSG for a while. Eventually, AW began to reduce the spread as the probability of another WMI offer decreased.

Merger arbitrage is not without risk. If you would have bought Yahoo! at 28.00 after the Microsoft offer, you'd be down about 30% as of 8/28/08. Merger arbitrage can be very dangerous. Try to pick deals that you believe are very likely to close.

I have created a spreadsheet so that you can run some merger arbitrage simulations yourself (you could have created one, but this can at least get you started or help you figure it out if you're still not sure).

Merger Arbitrage Spreadsheet

Whether you invest or not, it's very interesting to see the dynamics of stock prices when mergers are involved. Just like any investment, merger arbitrage is risky; nevertheless, it's interesting to see and can be a fun way to invest.

|

|