Is it wrong to Walk Away from Your Mortgage?

Foreclosures and Short Sales

The housing market crash has brought many homeowners to question whether they should walk away through strategic foreclosure or a short sale of their home. While there are many arguments for and against walking away, generally it is ethically wrong to foreclose or use a short sale if you are not in financial trouble.

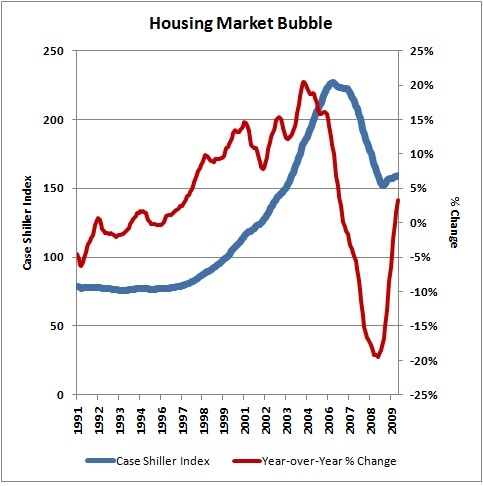

The economic incentive for homeowners to walk away from their homes has increased dramatically over the past four years. Historically, home values have increased in most markets a few percentage points per year; however, with the housing bubble that began to heat up as far back as 1997 only to subsequently burst beginning in 2006, homeowners have increasingly found themselves under water, which makes walking away very tempting.

When a homeowner owes more on his house than it's worth, many financial and psychological factors come into play. First, the underwater homeowner realizes that he could potentially save hundreds of dollars a month by renting rather than living in his current home. The homeowner may also realize that it could potentially take years for his home to recover its value, which gives little incentive to wait it out. The decrease in value causes the homeowner to also blame the banks, the industry, Wall Street, or various other scapegoats (which have also been blamed by the government to a large extent). Some homeowners also get into real financial difficultly which makes mortgage payments impossible.

The primary argument that seems to appear from people choosing to walk away from a home through foreclosure or even a short sale, is that the banks "deserve" it. It is true that banks gave risky loans to people who in some cases could barely afford them; however, remember that most banks did not foresee the housing crash any more than people purchasing the homes saw it. It is easy to blame corporations, especially in this ever-more-populistic society we live in: corporations are trying to make money, they are generally wealthy, and we don't have a personal relationship with them like we may have with a family member. Moreover, as the media has pointed out, some banks have walked away from investments just as if they were an underwater homeowner. Still, there are many flaws with these arguments. First, the responsibility of the loan lies with the homeowner. A home loan is a huge commitment, any person that takes it lightly is being irresponsible. The homeowner is the one that approached the bank in the first place -- perhaps the bank advertised, but the homeowner requested the loan. Since most banks suffered from the housing market along with homeowners, it is hard to assign a greater share of the culpibility on the banks. Finally, while banks are in the business of making money, it must be remembered that the homeowners are, too. Homeowners work for banks, purchase banks' stock (perhaps through a pension or a mutual fund in a 401k), and in most cases were happy that the bank gave them a loan.

It is easy to blame banks and walk away from a loan since the one who suffers will be a giant corporation, but consider what most homeowners would do if the person that gave them the loan was a family member or close friend. Would the homeowner then be as willing to walk away?

Politicians have been quick to point fingers and place blame, but some of the same politicians pointing fingers also pushed Fannie Mae and Freddie Mac to provide more loans. The intention was to increase home ownership and allow people to live the American Dream. The effect was that too many people got into homes that shouldn't have.

No matter what the rationalization, walking away should be avoided if possible. Perhaps the people who are the least morally obligated to stay in their homes, are those that are unemployed. If someone cannot afford a home due to a change in employment circumstances, then it is largely out of their control.

What many homeowners who choose to walk away do not consider, is their how their actions will impact other members of society. When someone walks away from a home through a foreclosure or short sale, it reduces the value of all the surrounding homes. This increases the incentive for other people to walk away, and the spiral continues downward.

Finally, on a personal note, I want to say that I know how most people feel. I purchase a home in Arizona in early 2006 which has fallen to half of the value at which it was purchased. When I wanted to move out of state, my wife and I decided to rent out the home at a significant monthly loss. It would be much better financially to walk away from it, but we feel that we committed to pay off the loan, so that is what we plan on doing. I don't write this to be noble or holy, but to point out that it is a decision that most people can choose to make.

B. Taylor, 22 June 2010

Comments

|

|